Survive in School

Academics

Finance

Guide to Personal Finance

Managing Money

Student Credit Cards

Money Saving Tips

Free Credit Reports

Build Your Credit Score

Employment

Loans and Taxes

Loans and Taxes

Lifetime Learning Credit

HOPE Scholarship

Employer Assistance

Deducting Loan Interest

Budgeting

Health

If you have a credit card, have student loans, or have borrowed in any capacity then you need to know the basics about your credit report and credit score. In your earliest days of credit owing it can be fun and liberating to have what seems like a magic supply of funds on hand. But if you don't keep things in line you can find yourself in a good bit of financial trouble. Plus if you ever plan on borrowing again or buying anything of substance down the road then your credit score will either help you or hinder you.

Think not? Businesses check your credit ranking if you're signing up for a mobile phone contract and also if you're trying to rent a house, so it's not just the big things like mortgages or a new car that requires better than average credit. So before you find yourself in a financially embarrassing situation you need to know where you stand by getting a current credit report.

A credit report is a record of your history with borrowed money. The information is maintained quite meticulously by three main credit bureaus: Experian, Equifax and TransUnion. When you apply for  credit, just like when you applied for student loans, the lender checks your credit report to see how you repaid the debt, if at all. Essentially your credit report tells a lender whether you are a reliable borrower or not and due to government crackdowns and people defaulting on loans, it's not as easy to get credit as it once was.

credit, just like when you applied for student loans, the lender checks your credit report to see how you repaid the debt, if at all. Essentially your credit report tells a lender whether you are a reliable borrower or not and due to government crackdowns and people defaulting on loans, it's not as easy to get credit as it once was.

In addition to showing if you're a safe bet the credit report also contains information about your place of residence, your job, and how and when you pay your bills. Other information such as whether you've filed bankruptcy in the past or have been sued may also be included in the report. The information will most likely show your current account balance on credit cards and loans, and your credit limit, along with any records of delinquent or defaulted loan payments.

Did you know that you can have access to a free credit report from each of the major reporting bureaus annually? Contact them directly for a current copy of your free credit report. It's important that you know how your credit activities will appear to future lenders.

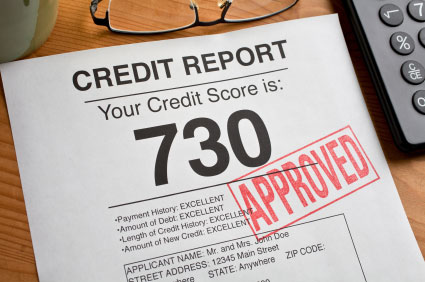

A credit score is like the numerical version of your credit report. It is basically a quick and easy way for creditors and lenders to see if you are creditworthy. Credit scores range from 300 to 850. The higher your score the better your creditworthiness.

For United States borrowers the average FICO credit score is 692.

High credit scores are obviously the goal. This means borrowing power. Lenders are eager to make loans to responsible borrowers, when history has shown you'll pay it back, with interest and on time. You can think of a high credit score as a merit badge, and it's required for many of the things you'll most likely want out of life in the future.

True, the goal is to not have a low credit score because many lenders rely on the score as the determining factor to your borrowing power. Low credit scores can endanger your chances for any kind of credit, even qualifying for an apartment rental. And bad credit will certainly hurt your potential as a prospective homeowner. However if you do find that you've got credit problems you can still work to resolve your financial woes. Not all hope is lost, no matter how far you've sunk. Learn how to resolve you credit issues here.

With a combination of forethought and diligence you can either keep your credit on track or get it back to a place of good standing – making you an upstanding financial citizen who's got a solid education and the drive to take on the world.